FAQ

Before investing in any offering on Rally please be sure to review important investment documents located in the legal section of each asset portal. It is VERY important to us that you completely understand all of the risk factors when investing in our securities. Visit Disclaimer and Terms of Service for additional information.

-

What is Rally?

Through Rally, people are able to invest in premium quality collectible assets through a simple mobile app and website. Our team of experts hand select each investment opportunity. We then acquire the assets, securitize them (turning them into equity shares), and make them available to investors, who can create custom diversified portfolios by holding stakes in multiple assets and asset classes.

-

How does it work?

We acquire rare collectibles that we believe are appropriately priced and will increase in value over time. We share all key information about the assets with you through our user-friendly mobile platform, including provenance and ownership history, photos and videos, as well as past sales of comparable assets. If you like what you see, you can invest in each specific asset.

Your trust and safety is important to us, so we partner with FINRA registered broker-dealers who confirm investor identities, issue shares, and oversee all transactions. We also invest alongside you on every investment offering, so you can be sure we are incentivized to select great assets and manage them with a focus on long-term returns.

-

Who owns the assets?

All of the assets are held by one of our subsidiary companies, RSE Collection, LLC, RSE Archive, LLC or RSE Innovation, LLC. When you invest in an asset, you become a shareholder in a specific asset through one of these sub-companies.

-

Where are the assets kept?

The assets are securely stored in our state-of-the-art, climate-controlled facilities. They are monitored by trained local staff and are kept under 24/7 video surveillance.

-

What types of securities do you offer on the Rally platform?

Rally only offers securities that are regulated by the U.S. Securities & Exchange Commission (the “SEC”) to protect our investors. You can find additional information on the specific SEC regulations that we rely upon, here, here and here.

Important Note: At this time our securities are offered for sale through a registered broker-dealer (and member of FINRA & SIPC) that is licensed in all 50 U.S. states.

-

Who are you guys?

Our founders, Chris, Rob & Max, are three life-long friends, who have always followed the collector car market, made some great investments, missed out on some others, but never felt like we had an access lane to get inside the velvet rope. They set out to leverage their experience as a tech entrepreneur, product designer and investment banker to democratize alternative asset investing, and ensure that it keeps up with the times and continues to engage future generations.

Rally is fortunate to have industry experts on our team who keep us abreast of key developments and ensure we maintain best practices. Our advisory board includes leaders in both the collectible and financial fields, and our senior staff and investors bring experience from some of the world’s leading companies and institutions, across tech, finance, and academia.

-

How are the assets selected?

We factor rarity, significance, history, originality, value, condition and additional data-driven factors into every decision we make to acquire these collectible assets. We look for best-in-class assets and investigate whether they have been properly maintained or restored. We’re always working to find great assets for our community and we keep a database of target assets so that we can act fast when they become available at the right price. Our offering is eclectic so there are options for different tastes, time horizons and investment strategies.

-

Can I register for Rally as a US business?

Businesses located and operating in the United States may be eligible for a business account on Rally and are evaluated on a case by case basis. For inquiries related to registering as a business on Rally, please reach out to hello@rallyrd.com.

-

How can I submit an offer to buy one of the assets?

You are able to submit a buyout offer directly through the app! If the asset you wish to submit an offer for has already opened for secondary trading, you will be able to click the “Want to buy this asset? Let’s talk” button at the bottom of the asset’s home page!

-

I have an asset I think would be a great fit for Rally — can I list it on your site?

Please feel free to visit our asset submission site at https://rallyrd.com/sell-with-rally/ to submit any items you think would be a good fit for the Rally platform. Our asset acquisition team will reach out directly if there is potential interest in the asset!

-

What are the Rally NFTs?

What are the Rally NFTs?

A limited number of investors in various series LLCs that are affiliates of Rally Holdings LLC (collectively, the “Rally Entities”) may be eligible to purchase a Rally NFT, each of which may take the form of a digital graphic available in a variety of unique designs with varying rarity. The Rally NFTs are randomized at checkout, meaning that a purchaser can be assigned a Rally NFT design at random during the checkout process. Purchasers of the Rally NFTs will receive their Rally NFTs within 72 hours of purchase, delivered to the wallet of their choosing.

What do the Rally NFTs represent?

The Rally NFTs are commemorative only and memorialize participation in a particular offering of a Rally Entity. The first Rally NFTs were sold in connection with the offering of Series #PUNK9670 of RSE Archive, LLC and took the form of a digital hologram labeled as a “stock certificate.” The Rally NFTs do not represent an ownership interest in any series of any of the Rally Entities or any of their underlying assets, including any NFTs owned by the Rally Entities, do not provide a right to receive any distributions made by any series of any of the Rally Entities, and do not guarantee the right to participate in any future offerings of interests in any of the Rally Entities.

Are there any rights or perks associated with ownership of the Rally NFTs?

Holders of the Rally NFTs may from time to time receive free merchandise, access to special events or promotional items, at Rally’s discretion. Like all Rally investors, holders of a Rally NFT may occasionally receive early access to offerings on the platform, but no such access is guaranteed. You must hold the Rally NFT at the time any such perk is granted in order to have the right to any perk associated with the Rally NFTs.

Will Rally offer NFTs in the future?

Rally may sell Rally NFTs or other commemorative items or merchandise in connection with future offerings or otherwise.

-

How do I invest?

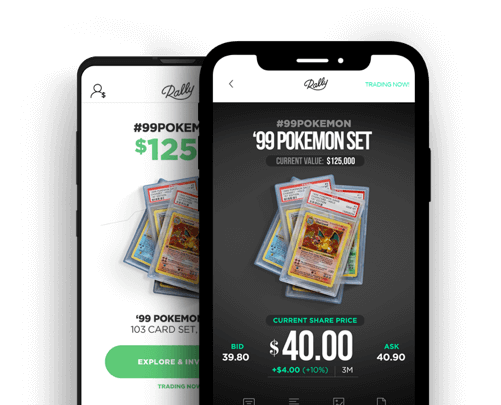

During an asset’s initial offering, you simply click on the ‘Buy Shares’ button at the bottom of that asset’s portal to participate in the Initial Offering of shares, select the number of shares you wish to purchase, and complete the investor on-boarding questionnaire. You will be asked to provide some personal and financial information (as required by law) and to link a bank account and deposit funds to pay for your shares. Upon receipt and acceptance of investment documents from you and your co-investors, our broker-dealer will close the offering and process the transaction.

For Trading Assets, the process is very similar, but you can place orders to buy shares (“BIDs”) or orders to sell shares (“ASKs”) at any time. During this order flow simply select the maximum price per share that you are willing to pay or minimum you are willing to accept (a “limit order”). However, no matching of buyers and sellers will occur outside of market hours (10:30AM – 4:30PM, Monday – Friday).

-

Who can invest?

Anyone over 18 with a U.S. Social Security number (that passes standard know-your-customer and anti-money-laundering checks), Bank Account, ID, and address within the contiguous United States is eligible to invest, but the app itself is free and open to everyone.

If you want to invest through a company or partnership, please contact us at support@rallyrd.com. Unfortunately, we are not able to accept investments through ERISA or IRA plans at this time.

Important Note: At this time our securities are offered for sale through a registered broker-dealer (and member of FINRA & SIPC) that is licensed in all 50 U.S. states.

-

Can I invest from outside the United States?

At this time, Rally is only available to individuals with a United States SSN, bank account, identification, and an address within the contiguous United States.

We’re committed to making Rally available for as many users as possible around the world, and will be sure to keep you updated on our progress here.

-

If I invest, can I see the assets?

All of our assets are museum-quality, so we treat them accordingly. That means top-notch security, insurance, and state-of-the-art facilities. Our showroom at 446 Broadway, New York, NY, is scheduled to re-open in Summer 2023, where you will be able to see a rotating selection of Rally assets regularly displayed.

-

How can I update my address?

You are able to change your address on the web-version of the Rally platform (rallyrd.com/app)! If you sign in and navigate to the “settings” tab on the left-hand side of the window, you will see a menu labeled “Personal Information” with a button that says “edit” to the right of it. In that menu, you are able to update your address.

-

What are some key terms & phrases I should be familiar with?

Initial Offering: The first time an asset is being offered as an investment on Rally.

Secondary Trading: Transactions in Series Interests between investors after the primary issuance of such Interests by a Rally Entity. Offers to buy shares (“BIDs”) or orders to sell shares (“ASKs”) for Trading Assets are being accepted at any time after the lock-up period for an Asset ends. However, no matching of buyers and sellers will occur other than during market hours (10:30AM – 4:30PM, Monday – Friday) as established by the PPEX ATS, as discussed under “Trading Through Rally.”

Active Assets: Assets that are open to investment. You can reserve shares for purchase at a later date or invest on the spot.

Private Assets: Assets that aren’t open to investment but may be in the future. We provide key information on them and give you the opportunity to sign up to be notified when you can invest.

Trading Assets: Assets that are accepting offers to buy or sell shares, which can be submitted at any time. Please note that not all Assets on Rally will become available for Secondary Trading, and information about which Assets will not become available for Secondary Trading will be provided through our offering circulars filed with the Securities and Exchange Commission and through the Rally app.

Locked-Up Assets: Assets that have been fully-funded and are in a three-month “lock-up” period before Secondary Trading opens.

Liquidated Assets: Assets that we have sold and are no longer available on the Rally platform.

Active Investment: Your current holdings. Once you have made an investment, either in an initial offering or through Secondary Trading, your shares will show up under the “Active / Current Investment” tab in your account.

Pending Investment: A share purchase that has been placed or reserved, but not yet finalized. You can monitor it in your account.

Exited Investment: An investment that you have sold; your receipt and financial results remain in your account.

Comparable Asset Value: Prices of similar assets that may help you determine the fair value of a potential investment. Our interactive chart allows you to see the historical prices of comparable assets and other expert valuations as well as details about each transaction. There’s no guarantee that an asset’s performance will mirror its ‘comps’, but it’s certainly valuable information.

PPEX ATS: The Public Private Execution Network Alternative Trading System (“PPEX”) is an Alternative Trading System (“ATS”), run by North Capital Private Securities Corporation, a registered broker-dealer (and member of FINRA & SIPC). The ATS is responsible for matching all secondary trades submitted by buyers and sellers in the secondary market for shares you buy through Rally.

-

How can I make money on Rally?

When you purchase shares on Rally you invest in an ownership stake in a mini-company that owns and operates a specific asset. If its value rises, so should the value of your shares. If it earns more money than it costs to operate, you can get paid dividends. When you decide to sell your shares, you place an order through our partner broker dealers who will match you with potential buyers on the PPEX ATS.

-

What are the risks?

All investments carry risks and those on our platform are no different, so it’s important that you understand them. The value of your investment can fluctuate—in both directions—and there’s no guarantee that there will be a buyer offering your desired price when you want to sell.

Furthermore, collector cars and collectibles are real assets, and while that’s certainly part of their appeal, it brings risks. The Offering Circular (“OC”) or the Private Placement Memorandum (“PPM”) for each offering details risk factors and is available for your review in the “Legal” section of the asset page. In addition, you can go to www.rallyrd.com/disclaimer for further information.

-

Are you a Broker-Dealer?

Rally is not a broker, but we do partner with FINRA & SIPC registered broker-dealers who perform services relating to transactions of our securities.

-

Can I buy shares even if I missed an initial offering?

Yes, if you missed out on an initial offering you can still place buy orders (“BIDs”), after the lock-up period for an Asset is completed.

-

Do I need to be an accredited investor to invest?

No, the vast majority of the investment opportunities on the App are available to all investors, provided that you do not invest more than 10% of your annual income or net worth in any of our offerings. If you are accredited, that limitation does not apply.

-

Are there fees to Buy or Sell shares?

Our fees reflect our goal to democratize the alternative asset market. In order to keep barriers to participation as low as possible, we don’t charge any commissions or management fees on the value of your investments. And the App is free, so you can browse and participate in community features at no cost.

At this time, Rally makes money by taking a sourcing fee on each initial offering. This figure is included in the offering price reflected in the App and the complete breakdown and exact number is reflected in the offering circular reviewed as part of the investment process for each asset.

-

How do I pay for my investments?

You can pay for investments by linking your bank account to the Rally App. All transfers in and out are made via an automated-clearing-house (“ACH”). For security protection, we ask that you verify that the linked bank account belongs to you before you can start investing. You can do this instantly by securely logging into your online banking account through our integration with most major banks.

When you sell shares (or if your investments earn dividends), the money will be added to your Rally balance. You can view your balance at any time by clicking the “$” icon in the upper right-hand corner of the App. You can use these funds to make new investments, or simply withdraw them back to your personal bank account.

Note: We recommend linking a Checking account to avoid potential issues. Savings, money market and brokerage accounts are more often subject to restrictions on ACH transfers.

-

Will I receive any monthly statements or end of year tax documents?

Yes, but only when necessary for your reporting purposes. You will receive a 1099 if you have sold shares or if you have received dividends during the calendar year. If you just purchased shares then you won’t receive a 1099. Tax documents will become available through your Portfolio in March of the following year.

Monthly statements are only available if you have active investments in your portfolio. Statements are typically ready to view in your Portfolio by the first week of every month. New investments generally take two months to reflect in your statements.

-

When do you sell the assets and what happens when you do?

In general, we intend to hold assets for the long term. However, we do keep close tabs on investor sentiment through the app, as well as broader market conditions. If we do liquidate an asset, the proceeds get paid to the shareholders (similar to a company acquisition).

Secondary Trading provides flexibility to investors. Instead of having to wait for an asset to be sold to exit your investment, you are able to decrease your exposure in an asset by selling some or all of your shares on the secondary market. Likewise, you are able to buy shares in an asset even if you missed its initial offering. So it pays to always keep tabs of what’s available through the app!

-

How do Buyouts on Rally Work?

An asset is eligible to receive buyout offers at any point after the completion of that asset’s Initial Offering. In order for an asset to exit the Rally platform, a qualified, legitimate offer must be presented to investors.

Buyout offers are placed through the Rally app by selecting the “Buy this Asset” link at the bottom of that asset’s main page, and submitting an offer. Once placed, our team qualifies both the offer and the potential buyer to make sure both are legitimate.

All qualified offers are presented to shareholders for a non-binding poll. This poll is conducted via email and contains all pertinent buyout details including potential returns. Each shareholder may respond only once per poll and can select “Yes”, “No” or an option to let our Advisory Board decide on their behalf. During the buyout process, all trading (Live and Post-Only) for the asset is halted, pending the results of the poll.

Upon conclusion of the poll, results are distributed to Rally’s 3rd-party Advisory Board. The Advisory Board takes into account both individually-weighted and share-weighted poll results as well as market conditions when making a decision. To date, the Advisory Board has only voted yes when either the individual-weighted results, share-weighted results, or both, indicated “Yes,” but reserves the right to do otherwise if appropriate.

After a poll ends, results are shared with our 3rd-party Advisory Board who have 24 hours to ratify the results of the poll. After this period, results are then distributed to both investors and the potential buyer – if a sale is accepted, funds will be distributed to investor’s accounts within 7 business days of the sale.

If a buyout offer is rejected, any follow-up offer from the potential buyer must result in at least an additional 10% return to shareholders to qualify for another poll.

-

What Qualifies a Buyout Offer for a Shareholder Poll?

If a net (after corporate taxes and entity fees) offer is greater than the current in-app value, Rally will conduct an in-depth analysis to determine if the offer falls within the current fair market value range for an asset. Rally calculates fair market value by looking at direct sales, comparable sales, indexes, and other market trends. This can change frequently depending on auction and private sale data.

When a user submits a buyout offer that doesn’t qualify for a shareholder poll, Rally will respond with our determination on the asset’s current value.

Once an offer is qualified, Rally collects an escrow deposit from the buyer, pauses trading of shares in the asset, and sends the poll out – users have 48 hours to respond.

-

How are Competing Buyout Offers Handled?

Competing offers may be accepted within that 48-hour period. If a competing offer exceeds an outstanding offer by 5%, the original offeror has a chance to match or beat that competing offer. Both offerors will be given the chance to respond to the other’s most recent offer, increasing their bids by 5% (or more) increments until there is one bidder left.

If poll results indicate both the majority of shareholders and shares were voted “YES”, a higher offer doesn’t trigger a second poll, and investors are notified along with final results that there is a higher payout coming. If poll results indicate a “NO” and a higher offer came in after the original notification, Rally will re-initiate a second vote so investors can consider the higher offer. Note: Any potential buyer that votes YES with their own shares is bound to that vote regardless of if they are the eventual winner.

-

What happens if I own a share of an NFT that receives an airdrop?

In the event of a project airdropping a new NFT to reward owners of a particular NFT that is held on the platform, Rally will conduct an investor survey similar to the one used for Buyout Surveys. Investors in the asset will have the ability to provide input into the decision on whether the airdropped NFT is (a) held on the platform and incorporated into the Series of the original underlying NFT, or (b) sold for a cash distribution.

If the poll result is “hold”, the derivative NFT will be incorporated into the Series of the original underlying NFT as a combined item, for example “Bored Ape & Mutant S1 Serum.”

If the poll result is “sell”, Rally would place the item for sale and revenue from the sale would be distributed to shareholders in USD on a share-weighted basis, less the “gas” fees and applicable taxes associated with the sale. This would target to happen within 10 days of the poll ending.

-

What happens if I own an NFT that is eligible for a token airdrop?

Rally will evaluate token airdrops on a case-by-case basis. If the token airdrop meets Rally’s predetermined set of criteria described below, the token will be claimed and distributed to investors in the form of USD. The distribution of USD will be on a share-weighted basis, less the “gas” fees and applicable taxes associated with the token claiming process.

Rally will only claim airdrops on behalf of investors if the airdrop meets a predetermined set of criteria:

- Token must be issued by a reputable platform or marketplace or verified creator or artist

- Token must be deemed safe by the community and Rally. We’ll generally require a token contract to be audited and members of the crypto/NFT community to embrace the airdrop.

- Token’s value must result in a USD payout greater than 5% of the asset’s initial offering market cap.

Once claimed, tokens will be exchanged for USD and transferred to the bank account of the Series NFT that claimed the airdrop. After transaction fees and taxes have been withheld, remaining USD will be divided amongst shareholders and distributed to individual cash balances on a share-weighted basis.

-

What is Instant Cash?

In the past, funds transferred to your Rally Cash Balance could take 1-2 business days to clear before being able to be used to place orders in the secondary market.

With Instant Cash, funds transferred via this feature will instantly be available for use on the secondary market. Information regarding eligibility and transaction size restrictions can be found in the additional questions below.

-

Can Instant Cash be used for Initial Offerings?

Instant Cash can only be used for secondary market transactions, and funds from Instant Cash may not be used to invest in Initial Offerings. However, for Initial Offerings, users are not required to pre-load their Rally cash balance – when a user makes an investment the funds will be transferred directly from their linked bank account.

-

Who is eligible for Instant Cash?

In order to use Instant Cash, you will need to have a Plaid linked bank account.

-

What are the fees associated with Instant Cash?

The fee to utilize Rally Instant Cash is 1.5% of the amount being transferred with a $0.25 minimum fee per transfer. New users will have a free trial period of 14 calendar days from sign up in which the fees are waived. After the expiration of the trial period, the fees will automatically be applied to future transfers.

Instant Cash fees are applied on top of the transfer amount, and will not be applied as a second ACH debit on your bank account. For example, a $100 Instant Cash transfer would result in a $101.50 bank account debit.

-

Are bank transfers of all sizes eligible for Instant Cash?

At this time, Instant Cash can be used for secondary trading transfers up to $1,000 total over a 2-3 business day period.

-

What if I prefer not to use Instant Cash?

If as a user you would prefer to preload your Rally cash balance and avoid paying the 1.5 % fee – simply sign into your Rally account and initiate a deposit directly through your Portfolio.

Deposits on iOS

If you’re on iOS, after you open the Rally app you can tap the top left button to get to ” My Portfolio”. Then hit “Banking”. Once you’re there, hit “Transfer from your Bank”, type in an amount, and tap the green “Transfer” button.

Deposits on Web

If you’re on web, you can login at rallyrd.com/app – then hit the “My Portfolio button” on the left column. Then hit “Deposits / Withdraws” Once you’re there, hit “Transfer from your Bank”, type in an amount, and tap the green “Transfer” button.

-

What is Live Trading through Rally?

Rally’s technology platform allows buyers & sellers to place BID and ASK orders for shares of specific assets, which orders are routed to Dalmore, a broker-dealer, for matching on the Public Private Execution Network Alternative Trading System (the “PPEX ATS”). BIDs and ASKs are eligible to be matched and executed in real-time during Market Hours (Monday through Friday, excluding standard stock market holidays, from 10:30AM (ET) – 4:30PM (ET)) as established by the PPEX ATS. The PPEX ATS is owned and operated by North Capital Private Securities Corporation.

All brokerage services relating to secondary market trading are provided by Dalmore, a member of the Financial Industry Regulatory Authority (FINRA) and the Securities Investor Protection Corporation (SIPC). All answers in this FAQs related to secondary trading are being provided by Dalmore Group, LLC.

-

How Does Trading on the PPEX ATS Work?

During Market Hours, any order for which the PPEX ATS determines that a match exists between a buyer and seller for a particular asset will immediately be executed by Dalmore.

Outside of Market Hours, investors are still able to use the Rally App as an interface to place BIDs and ASKs on any asset that is “Accepting Orders.” These BIDs and ASKs will instantly be routed via Dalmore to the PPEX ATS. The orders will be eligible to execute pending a match upon opening of Market Hours.

-

How can I sell my investment?

You can attempt to sell some or all of your shares through the Rally App, which is the interface for investors to place BID and ASK quotes that are routed via Dalmore to the PPEX ATS for matching. While your shares are not listed on a public stock exchange, like NASDAQ or NYSE, the trading process provided by the PPEX ATS should feel familiar. Note that the PPEX ATS is the sole trading venue for all orders placed through the Rally App (as the user interface). However, investors are not restricted to the App for trading shares. You may attempt to trade on an alternative secondary market, if one is available, but the Rally App will not connect you to such markets. The information provided in these FAQs relates solely to transactions conducted on the PPEX ATS using the Rally App as the user interface, and it does not apply to any secondary trades conducted by other means.

After an asset’s Initial Offering, we impose a 90-day “lock-up” period during which shares cannot be bought or sold. Once the “lock-up” period is over, the “INVEST” button is replaced with “BUY” and “SELL” buttons so you know the asset is trading. You can submit offers to sell your shares at any time after the lock-up period by submitting sell orders (“ASKs”) through the App. However, the PPEX ATS will not match buyers and sellers outside of Market Hours as established by the PPEX ATS.

-

How do I place a BID or ASK (how to buy or sell shares)?

Ensure that you have the latest version of the Rally App from the iOS App Store or visit our web application at app.rallyrd.com.

Navigate to an asset that is eligible for secondary trading and select the BID (Buy) button to purchase shares or the ASK (Sell) button to sell shares. In order to place a BID, an investor must have a cash balance in their Dwolla account, which is created and accessible through the user interface provided by the Rally App, equal to or greater than the total amount of the order, and in order to place an ASK, the Rally App requires that investors must currently own shares in that particular asset and have held those shares for a minimum of five business days.

Enter the number of shares and a limit price per share. In accordance with the matching procedure of the PPEX ATS, ASKs will be eligible to be matched at or above that price per share, and BIDS will be eligible to be matched at or below that price per share.

Review your order and submit it. If your order is matched by the PPEX ATS during Market Hours, Dalmore, as executing broker, will immediately execute your order. If the order is not eligible to be matched, or it’s outside Market Hours, the order will show up in the asset’s specific order book, which is maintained by the PPEX ATS, until matched or canceled.

View your pending or executed order details anytime by navigating to the “Portfolio” section of the App.

As a reminder, your Dwolla account, which is created and accessible through the user interface provided by the Rally App, must contain an available cash balance equal to or greater than the total amount of the order to place a BID, and you will need to own shares in an asset that have completed the settlement process (held for five business days after execution) in order to place an ASK.

-

What is “Instant Buy”?

During Market Hours, a user may be able to place an order to purchase one share of any eligible asset by selecting “Instant Buy” during the order process. This allows a potential buyer to place a limit order to purchase one share at the lowest available ASK, which would execute instantly for both the buyer and seller. To select “Instant Buy” the investor must have a cash balance in their Dwolla account, which is created and accessible through the user interface provided by the Rally App, equal to or greater than the total amount of the order. To place an order for more than 1 share, or to specify a custom price per share, use the limit order option.

-

How does order matching work?

The PPEX establishes the rules for matching orders to buy and sell shares. Orders are matched by the PPEX ATS when the price of a BID and an ASK are equal or cross each other, prioritized based on “best price” and time submitted.

Prices cross when a BID is placed at a price higher than any current ASKs on the order book, or vice versa when an ASK is placed at a price lower than any current BIDs. All open orders are viewable on the Rally App 24/7 in an asset’s order book, which is maintained by the PPEX ATS. As a reminder, crossing orders eligible to be matched by the PPEX ATS will not match until Market Hours. Outside of Market Hours, orders eligible to match will be matched by the PPEX at the start of Market Hours and subsequently executed by Dalmore.

If multiple users have an order (either BID or ASK) at an identical price for a given asset, that order will be matched in order of time priority – so whatever order was submitted first to the order book would receive priority to be matched and executed first. That is, the orders that were first submitted will be the first to get matched by the PPEX ATS and executed by Dalmore.

Note – There are currently no market makers or liquidity providers on the PPEX ATS, and orders will only be filled if there is a matching order on the other side.

-

What happens if I place an order and it doesn’t get matched?

All orders placed are “Good Til Cancelled”, meaning the order remains active until the order is either matched (by the PPEX) and executed (by Dalmore) or canceled (by you). Until an order is canceled or matched, orders will remain open and can be edited or canceled from your Portfolio.

As a reminder, the cash equivalent to the total unmatched amount for any BID will be locked and will not be eligible for withdrawal or use on another order or investment until that order is canceled.

-

How do I know if my order was completed?

Once a BID to purchase shares is executed by Dalmore, a visual representation of your asset along with the total number of shares purchased will be visible in your Portfolio on the Rally App.

Once an ASK to sell shares is executed by Dalmore, the sale will be represented in your cash balance at the top of your Portfolio on the Rally App.

For both executed BIDs and ASKs, the transaction details will appear in your transaction history on the Rally App immediately upon execution. Though the change in ownership will be reflected immediately upon execution, custody of the shares will not transfer until the transaction is settled by North Capital Private Securities Corporation (“NCPSC”), usually within two business days of execution.

-

What are Market Hours?

During Market Hours on the PPEX ATS, BIDs and ASKs that match will execute instantly. Market Hours for all eligible assets occur Monday through Friday, excluding standard stock market holidays, from 10:30AM (ET) – 4:30PM (ET). The PPEX ATS sets its Market Hours.

-

What is the difference between “Market Hours” and the “Accepting Orders” Period?

During Market Hours, BIDs and ASKs that match on the PPEX ATS will be executed by Dalmore instantly. Market Hours for all eligible assets are set by the PPEX ATS and occur Monday through Friday, excluding standard stock market holidays, from 10:30AM (ET) – 4:30PM (ET).

The Accepting Orders period (sometimes referred to as “Post-Only”) occurs during all hours (not just Market Hours), allowing users to place BIDs and ASKs at any time. Orders will be eligible for matching on the PPEX ATS once Market Hours resume, and will be executed by Dalmore immediately upon matching. The Accepting Orders period allows all users to place BIDs or ASKs 24 hours per day, 7 days per week.

-

When will an asset be available to trade on the PPEX ATS?

After an Initial Offering is complete, all assets have a predetermined “Lockup Period” before they are available to trade. In the days leading up to the opening of Market Hours for a specific asset the Accepting Orders period will begin allowing investors to place their BIDs and ASKs on the Rally App to be automatically routed via Dalmore to the PPEX ATS prior to the official opening day of trading.

Rally will send email communications to all shareholders and all users who have selected “Notify Me” for all eligible assets in advance of an asset being available to trade. Once trading begins, all investors who own shares of an asset will see a denotation at the top right of the asset image within the main carousel highlighting the number of shares owned.

-

Is trading on the PPEX ATS available for all assets?

Most assets are available for secondary trading on the PPEX ATS following the Lockup Period, but we may decide that certain assets will not trade on the PPEX ATS, in which case the Rally App will indicate that the asset is not open for trading. Investors may seek other means of trading shares in secondary market transactions, but there is no guarantee that any other means of secondary trading will be available.

-

What is the timeframe to resell after purchase?

The Rally App requires that purchased shares must be held for 5 business days before being eligible to be re-sold.

-

Do I need a cash balance to place a BID?

In order to place a BID on the PPEX ATS (through the Rally App), your Dwolla account, which is created and accessible through the user interface provided by the Rally App, must contain a cash balance that is at least the equivalent of your BID.

Ex: If you would like to place a bid to purchase 10 shares at $5 per share, you will need to have an available cash balance of at least $50. If you don’t not have active funds in your Dwolla account, you can use Instant Cash, which charges a 1.5% fee of the transfer amount.

You can add cash to your Rally account by selecting “Banking” in the “Portfolio” section of the Rally App. Transfers from your bank account into your Rally balance take one business day to clear.

-

Why can’t I place a bid? (no available cash)

A cleared cash balance is required to place a BID.

Transfers from your bank account into your Rally balance take one business day to clear (see “What is Instant Cash?” for additional details). However, for Initial Offerings, you don’t need a cash balance. When you make an investment, funds will be transferred directly from your linked bank account when you invest (if there is no balance to pull from).

-

How can I view historical trading data?

We do not currently disclose trading or User data. For an asset that is trading on the secondary market, however, investors may use the Rally App to review a list of all BIDs and ASKs placed as recorded in the PPEX ATS’s order book. Additionally, the PPEX ATS’s order book displays the most recent matched price for each asset. The Rally App allows users to view the PPEX ATS’s order book.

-

How can I get trading alerts?

Rally will send email communications to all shareholders and all users who have selected “Notify Me” for all eligible assets in advance of trading. Once trading begins on the PPEX ATS, all investors who own shares of an asset will see a denotation at the top right of the asset image within the main carousel highlighting the number of shares owned.

-

How can I sell all my shares and close my account?

In order to close your account, you will first need to sell all of your shares and withdraw any cash balance. To sell your shares, you’ll have to place an ASK, and wait until that ASK is fully matched by the PPEX ATS and executed by Dalmore. Once you have sold all of your shares and transferred your cash balance to your linked bank account, our support team will be happy to help you close your account.

-

Can I cancel my BID or ASK?

At any point before an order matches on the PPEX ATS, you’ll have the option to edit or cancel any pending trades. All editing or cancellation of any pending order can be made from the Portfolio section of the App. Remember, the PPEX ATS may instantly match eligible orders during Market Hours, and once executed by Dalmore, an order is ineligible to be canceled.

-

How long does it take me to get cash after I have my ASK executed?

Once an ASK is fully or partially executed, the proceeds of that sale will be available in your account within two business days.

-

How long does it take to get my shares after a BID executes and when can I resell them?

Once a BID is matched by the PPEX ATS and fully or partially executed by Dalmore, the Rally App will display the transfer of ownership in the “Portfolio” section of the App to the buyer, but custody of the shares will not transfer until the transaction has settled, which typically occurs within two business days. Due to this settlement period, the Rally App requires that 5 business days must pass after execution of the purchase transaction before the shares may be resold.

-

How is an asset’s market value calculated?

All assets are valued on Rally based on their last traded price per share. An asset’s market value is the number of total shares issued multiplied by the last trade price.

Note – orders will only be filled if there is a matching order on the other side, and there are no guarantees that shares can be bought or sold at any specific price, including the last traded price per share.

-

Are there any limits on the types of orders I am able to place?

The PPEX ATS follows established, non-discretionary rules that determine when orders will match with one another. For more detail, see “How does order matching work?” above.

Additionally, the Platform imposes the following limitations on all orders to prevent market manipulation and to promote orderly trading:

ASKs cannot be below 30% of an asset’s last executed trade. As a reminder, an asset’s last trade price may change throughout the day, and the 30% range will adjust accordingly relative to the last trade.

An investor may not simultaneously have an open BID and ASK in the same asset.

An investor may not sell a share until it’s been held for five business days to allow time for proper settlement.

-

What does it mean when trading is paused?

Occasionally, Rally may pause trading on the PPEX ATS temporarily for a particular asset. When trading on an asset is paused, there will be no opportunity to enter BID or ASK orders on the Rally App. Potential reasons for a pause on trading include pending buyout offers or platform downtime or maintenance.

-

What is a partial match?

If, according to the application of the PPEX ATS’s matching process, only a portion of a user’s BID or ASK is eligible to be matched during Market Hours, the portion of the order matched by the PPEX ATS will be executed by Dalmore as an individual transaction, and the remaining portion of the order will remain open and be adjusted to reflect the updated unmatched portion.

An order may be partially filled multiple times, and until a partially matched order becomes fully matched, it will remain open and can be edited or canceled from your Portfolio.

For example, if User A placed a BID for 5 shares at $10, but there is currently only 1 ASK in the order book for $10 (and no other ASKs below User A’s chosen BID), then User A would receive 1 share. The remaining portion of User A’s order would remain in the PPEX ATS’s order book until it becomes fully matched.

-

How do I know it’s safe to invest on Rally?

All of our investments are reviewed and vetted by a FINRA registered broker-dealer and are subject to SEC regulation. We are committed to making investing with us as transparent as possible. Everything we see, you see. All the information we have on an asset is made available to all of our members, even those who don’t invest.

We are always here to help, so if you have any questions please don’t hesitate to get in touch at support@rallyrd.com.

-

How can I be sure that my personal Information is secure?

We store, maintain and insure all of the assets on the platform for the benefit of investors. We understand that their upkeep is critical to preserving and growing long-term value, so we adhere to strict guidelines. Since we always invest alongside you, it’s in our shared interest to manage assets to the highest possible standards and you can be confident we don’t cut corners. In the highly unlikely event of asset impairment, any insurance settlement will be used to repair the asset to its previous condition (when possible), or paid out to the investors as a liquidation event.

-

Are the assets secure & maintained?

We store, maintain and insure all of the assets on the platform for the benefit of investors. We understand that their upkeep is critical to preserving and growing long-term value, so we adhere to strict guidelines. Since we always invest alongside you, it’s in our shared interest to manage assets to the highest possible standards and you can be confident we don’t cut corners. In the highly unlikely event of asset impairment, any insurance settlement will be used to repair the asset to its previous condition (when possible), or paid out to the investors as a liquidation event.

-

What is the relationship between Dupont & Rally?

The relationship between DuPont and Rally is one where DuPont acts as the curator of the assets, while Rally serves as the issuer of the offerings. In this context, DuPont assumes the role of managing and overseeing the associated assets. As the curator, DuPont ensures the proper maintenance, preservation, and presentation of the assets, upholding their quality and value.

On the other hand, Rally operates as the issuer of offerings related to these curated assets. Rally facilitates the process of creating and selling fractional ownership in these assets to interested investors. By issuing offerings, Rally enables individuals to own a portion of the curated assets, providing them with an opportunity to invest in valuable items that may otherwise be inaccessible or unaffordable in their entirety.

Together, DuPont and Rally provide a platform that combines the expertise of asset curation with the accessibility of fractional ownership, creating opportunities for investors and enthusiasts to engage with valuable and unique items.

-

Who do I have an account with? (Dupont or Rally)

Your account is with Rally (rallyrd.com). When you open an account with Rally, the login information you create can be used to access both the Rally platform (rallyrd.com) and the Dupont REGISTRY. This means that you can use the same login credentials to access both platforms, allowing you to conveniently manage your account and access the services provided by both Rally and the Dupont REGISTRY.

-

Who is responsible for my data?

The responsibility for your data lies with Rally. When you open an account with Rally, we are the entity responsible for the storage and security of your data. Rally is committed to safeguarding your data and adheres to industry standard practices to maintain the privacy and security of your information within the scope of our platform.

-

Will all new cars on the Rally platform be listed under the Dupont REGISTRY?

Not all new cars on the Rally platform will be listed under the Dupont Registry. Going forward, the listing of new cars will vary between the Rally and Dupont platforms. Some new cars will be exclusively listed on Rally, while others will be exclusively listed on the Dupont Registry. This dynamic approach allows for flexibility in the listing process, taking into account various factors such as market demand, availability, and specific preferences of the car owners. By occasionally listing new cars on both platforms and sometimes exclusively on one, Rally aims to cater to a diverse range of buyers and ensure optimal exposure for the vehicles in their inventory.

Cautionary Statement Regarding Forward-Looking Statements

This FAQ includes some statements that are not historical and that are considered “forward-looking statements” within the meaning of Section 27A of the Securities Act. Such forward-looking statements include, but are not limited to, statements regarding our development plans for our business, our strategies and business outlook, anticipated development of the platform and our product offering, and various other matters. These forward-looking statements express expectations, hopes, beliefs, and intentions regarding the future. The words “anticipates”, “believes”, “continue”, “could”, “estimates”, “expects”, “intends”, “may”, “might”, “plans”, “possible”, “potential”, “predicts”, “projects”, “seeks”, “should”, “will”, “would” and similar expressions may identify forward-looking statements, but the absence of these words does not mean that a statement is not forward-looking.

The forward-looking statements contained in this FAQ are based on current expectations and beliefs concerning future developments that are difficult to predict. We cannot guarantee future performance, or that future developments affecting us will be as currently anticipated. These forward-looking statements involve a number of risks, uncertainties (some of which are beyond our control) or other assumptions that may cause actual results or performance to be materially different from those expressed or implied by these forward-looking statements.

You should not place undue reliance on any forward-looking statements and should not make an investment decision based solely on these forward-looking statements. We undertake no obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as may be required under applicable securities laws.