Trading on Rally

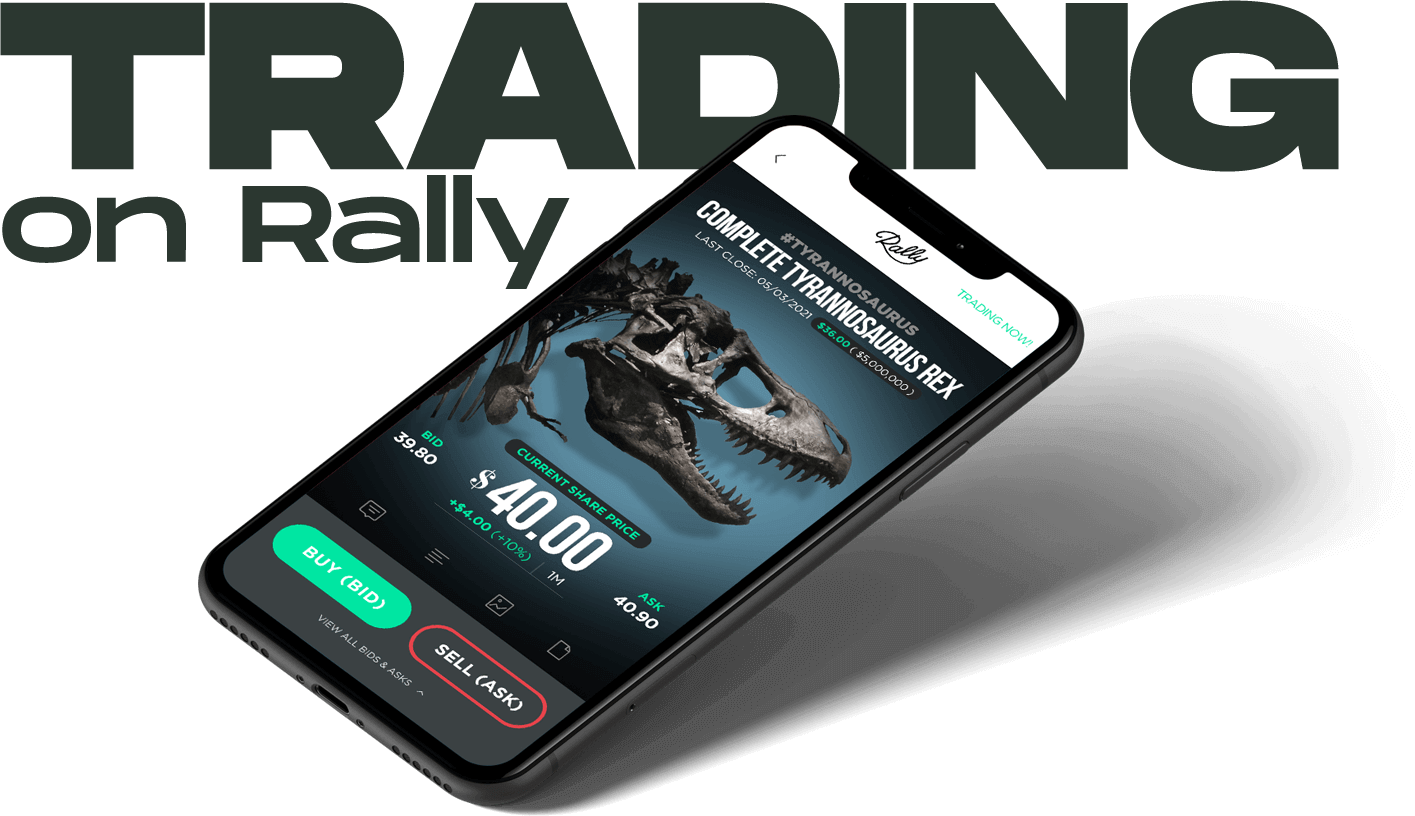

What is Live Trading on Rally?

Rally’s technology platform allows buyers & sellers to place BIDs and ASKs on specific assets, which are eligible to be matched and executed in real-time during Rally Market Hours (Monday through Friday, excluding standard stock market holidays, from 10:30am (ET) – 4:30pm (ET)).

All secondary market trading is offered through Dalmore Group, LLC, a member of the Financial Industry Regulatory Authority (FINRA) and the Securities Investor Protection Corporation (SIPC). All answers related to secondary trading are being provided by Dalmore Group, LLC.

How Does Trading on Rally Work?

During Rally Market Hours, any order where a match exists between a buyer and seller for a particular asset will immediately execute.

Outside of Market Hours, investors are still able to place BIDs and ASKs on any asset that is “Accepting Orders,” These BIDS and ASKS will instantly be entered into the order book, and be eligible to execute pending a match upon opening of Rally Market Hours.

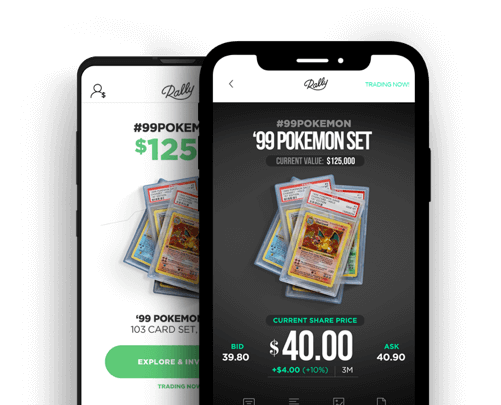

How do I place a BID or ASK (how to buy or sell shares)?

- Ensure that you have the latest version of the Rally app from the iOS App Store or visit our web application at app.rallyrd.com.

- Navigate to an asset that is eligible for secondary trading and select the BID (Buy) button to purchase shares or the ASK (Sell) button to sell shares. In order to place a BID, an investor must have a cash balance equal or greater to the total amount of the order, and in order to place an ASK, investors must currently own shares in that particular asset and have held those shares for a minimum of five business days.

- Enter the number of shares and a limit price per share. ASKs will be eligible to be matched at or above that price per share, and BIDS will be eligible to be matched at or below that price per share.

- Review your order and submit it. If matched, orders will execute immediately during Market Hours. If the order is not eligible to be matched, or it’s outside Market Hours, the order will show up in the asset’s specific order book until matched or canceled.

- View your pending or executed order details anytime by navigating to the Portfolio section.

As a reminder, you will need an available cash balance equal or greater to the total amount of the order to place a BID, and will need to own shares in an asset that have completed the settlement process (held for five business days after execution) in order to place an ASK.

What is “Instant Buy”?

During Rally Market Hours, a user may be able to place an order to purchase one share of any eligible asset by selecting “Instant Buy” during the order process. This allows a potential buyer to place a limit order to purchase one share at the lowest available ASK, which would execute instantly for both the buyer and seller. To select “Instant Buy” the investor must have a cash balance equal or greater to the total amount of the order. To place an order for more than 1 share, or to specify a custom price per share, use the limit order option.

How does order matching work?

Orders are matched when the price of a BID and an ASK are equal or cross each other, prioritized based on “best price” and time submitted.

Prices cross when a BID is placed at a price higher than any current ASKs on the order book, or vice versa when an ASK is placed at a price lower than any current BIDs. All open orders are viewable 24/7 in an asset’s order book. As a reminder, crossing orders eligible to be matched will only execute during Market Hours. Outside of Market Hours, orders eligible to match will execute at the start of Market Hours.

If multiple users have an order (either BID or ASK) at an identical price for a given asset, that order will be matched in order of time priority – so whatever order was submitted first to the order book would receive priority to be matched and executed first. That is, the orders that were first submitted will get matched and executed first.

Note – There are currently no market makers or liquidity providers on the secondary market, and orders will only be filled if there is a matching order on the other side.

What happens if I place an order and it doesn’t get matched?

All orders placed are “Good Til Cancelled,” meaning the order remains active until either the order is matched and executed or canceled. Until an order is canceled or matched, orders will remain open and can be edited or canceled from your portfolio.

As a reminder, the cash equivalent to the total unmatched amount for any BID will be locked and will not be eligible for withdrawal or use on another order or investment until that order is canceled.

How do I know if my order was completed?

Once a BID to purchase shares is executed, a visual representation of your asset along with the total number of shares purchased will be visible in your portfolio.

Once an ASK to sell shares is executed, the sale will be represented in your cash balance at the top of your portfolio.

For both executed BIDs and ASKs, the transaction details will appear in your transaction history.

What are Rally Market Hours?

During Market Hours on Rally, BIDs and ASKs that match will execute instantly. Rally Market Hours for all eligible assets occur Monday through Friday, excluding standard stock market holidays, from 10:30am(ET) – 4:30pm(ET).

What is the difference between “Market Hours” and the “Accepting Orders” Period?

During Market Hours on Rally, BIDs and ASKs that match will execute instantly. Rally Market Hours for all eligible assets occur Monday through Friday, excluding standard stock market holidays, from 10:30am(ET) – 4:30pm(ET).

The Accepting Orders period (sometimes referred to as “Post-Only”) occurs during all hours outside of Rally Market Hours, allowing users on Rally to place BIDs and ASKs, which, if matched, will execute once Market Hours resume. The Accepting Orders period allows all users to place BIDs or ASKs 24 hours per day, 7 days per week.

When will an asset be available to trade?

After an Initial Offering is complete, all assets have a predetermined “Lockup Period” before they are available to trade. In the days leading up to the opening of Market Hours for a specific asset the Accepting Orders period will begin allowing investors to place their BIDs and ASKs in the Order Book prior to the official opening day of Trading.

Communication via email will be sent to all shareholders and all users who have selected “Notify Me” for all eligible assets in advance of an asset being available to trade. Once trading begins, all investors who own shares of an asset will see a denotation at the top right of the asset image within the main carousel highlighting the number of shares owned.

Timeframe to resell after purchase?

Purchased shares must be held for 5 business days before being eligible to be re-sold.

Do I need a cash balance to place a BID?

In order to place a BID on Rally, you will need to maintain a cash balance that is at least the equivalent of your BID.

Ex: If you would like to place a bid to purchase 10 shares at $5 per share, you will need to have an available cash balance of at least $50.

You can add cash to your Rally account by selecting “Banking” in the portfolio section of

the Rally app. Transfers from your bank account into your Rally balance take one business day to clear.

Why can’t I place a bid? (no available cash)

A cleared cash balance is required to place a BID during Trading Windows.

Transfers from your bank account into your Rally balance take one business day to clear. However, for Initial Offerings, you don’t need a cash balance. When you make an investment, funds will be transferred directly from your linked bank account when you invest (if there is no balance to pull from).

How can I view historical trading data?

Though we do not currently disclose our Trading or User data, when a trading window is underway users are able to go into the Trading data for each specific asset and view all BIDs and ASKs placed. Additionally, you can view the most recent closing price for each asset that has had at least one active trading window.

How can I get trading alerts?

Communication via email will be sent to all shareholders and all users who have selected “Notify Me” for all eligible assets in advance of trading. Once trading begins, all investors who own shares of an asset will see a denotation at the top right of the asset image within the main carousel highlighting the number of shares owned.

How can I sell all my shares and close my account?

In order to close your account, you will first need to sell all of your shares and withdraw any cash balance. To sell your shares, you’ll have to place an ASK, and wait until that ASK is fully matched and executed. Once you have sold all of your shares and transferred your cash balance to your linked bank account, we will be happy to help you close your account.

Can I cancel my BID or ASK?

At any point before an order matches, you’ll have the option to edit or cancel any pending trades. All editing or cancellation of any pending order can be made from the Portfolio section. Remember, orders are eligible to instantly be matched during Market Hours, and any executed order is ineligible to be canceled.

How long does it take me to get cash after I have my ASK executed?

Once an ASK is fully or partially executed, the proceeds of that sale will be available in your account within two business days.

How long does it take to get my shares after a BID executes and when can I resell them?

Once a BID is matched and fully or partially executed, the shares will appear in your portfolio immediately. Purchased shares must be held for 5 business days before being eligible to be re-sold.

How is an asset’s market value calculated?

All assets are valued on Rally based on their last traded price per share. An asset’s market value is the number of total shares issued multiplied by the last trade price.

Note – orders will only be filled if there is a matching order on the other side and there are no guarantees that shares can be bought or sold at any specific price, including the last traded price per share.

Are there any rules around orders I am able to place?

The following limitations are imposed on all orders:

- ASKs cannot be below 30% of an asset’s last executed trade. As a reminder, an asset’s last trade price may change throughout the day, and the 30% range will adjust accordingly relative to the last trade.

- An investor may not simultaneously have an open BID and ASK in the same asset.

- An investor may not sell a share until it’s been held for five business days to allow for proper settlement.

What does it mean when trading is paused?

Occasionally, trading may be paused temporarily on a particular asset. When trading on an asset is paused, no orders will be accepted or executed. Potential reasons for a pause on trading include pending buyout offers or platform downtime or maintenance

What is a partial match?

If only a portion of a user’s BID or ASK is eligible to be matched during Rally Market Hours, the matched portion of the order will be executed as an individual transaction, and the remaining portion of the order will remain open and be adjusted to reflect the updated unmatched portion.

An order may be partially filled multiple times, and until a partially matched order becomes fully matched, it will remain open and can be edited or canceled from your portfolio.

For example, if User A placed a BID for 5 shares at $10, but there is currently only 1 ASK in the order book for $10 (and no other ASKs below User A’s chosen BID), then User A would receive 1 share. The remaining portion of User A’s order would remain in the order book until it becomes fully matched.

• • •

TERMS YOU SHOULD KNOW

Placing a BID

A BID on Rally represents the most you are willing to pay per share for an individual asset. You must have a cash balance to place a BID. All BIDs are placed as “Limit Orders” (a limit order is one that guarantees price, but not execution) and will remain active until either canceled or executed.

Placing an ASK

An ASK on Rally represents the price at which you are willing to sell your share of an individual asset. You must own shares to place an ASK. All ASKs are placed as “Limit Orders” (a limit order is one that guarantees price, but not execution) and will remain active until either canceled or executed.

Cancel/Edit an Order

Any order may be cancelled or edited until it’s matched during live-trading. Remember, once an order enters the order book it’s eligible to match at any point during Market Hours, without notice. Once an order is matched and executed it is ineligible to be canceled.

Limit Order

When buying or selling shares on Rally, you can input a custom price and quantity (up to the total number of shares issued for a given asset) at which you intend to buy or sell via BID or ASK. This is referred to as a Limit Order. If your order is matched, it will be executed instantly.

Instant Buy

During Market Hours, a user may be able to purchase one share of any asset with an unmatched ASK by selecting “Instant Buy” during the order process. This allows a potential buyer to purchase one share at the lowest available ASK, and executes instantly for both the buyer and seller. To place an order for more than 1 share, use the limit order option.

Partial Match

If only a portion of a user’s BID or ASK can be matched during Market Hours, the matched portion will be executed, and the remaining portion will stay in the Order Book.

For example, if User A placed a BID for 5 shares at $10, but there is currently only 1 ASK in the order book for $10 (and no other ASKs below User A’s chosen BID), then User A would receive 1 share. The remaining portion of User A’s order would remain in the order book until another user submits an ASK order of $10 or above, at which point the remaining portion of User A’s BID will be matched for the available quantity.

The reverse is also true. User A placed an ASK for 5 shares at $10. If a potential buyer placed a 1 share BID for $10, User A would only sell 1 share (for $10). The 4 remaining shares would remain pending in the order book and in User A’s portfolio under “Pending Transactions”.

Settlement Period

After selling shares, funds will typically settle to your account within 48-72 hours, at which point they may be withdrawn or deployed into another asset on Rally. After buying shares, your shares can be sold via placing an ASK after 5 business days.

Withdrawals

Once the Settlement Period has concluded, a user can select to withdraw their available cash balance to their linked bank account. Typically, the funds will be available in a user’s bank account within 3 to 5 business days.

The Order Book

The Order Book is where all open orders, both BIDs and ASKs, for an individual asset are listed, and when matched, will executer during Market Hours. During the Accepting Orders period, users can submit BIDs and ASKs to the Order Book for any available asset, which will then have the opportunity to execute during scheduled Market Hours.

Cancel/Edit Order

Orders posted to the Order Book may be edited or canceled unless your order was already matched & executed. Matched orders may not be canceled.

Last Traded Price

The Last Traded Price is the share price of the most recent, executed/matched BID/ASK. This price will always be visible on the asset page. The total Market Cap of the asset is updated with each executed trade, based on the Last Traded Price multiplied by the total number of shares of the asset.

Lockup Period

Once an Initial Offering is funded, no transactions in that asset occur during the “Lockup Period.” An asset’s Market Hours typically begin ~90 days after an Initial Offering is fully funded, which marks the end of the Lockup Period. During that lockup, the Accepting Orders period may begin prior to the expiration of the 90 days.

Market Cap

Market capitalization, or “market cap” is the aggregate market value of an asset represented in dollar amount. Total number of shares of an asset multiplied by the last traded price of that asset = the Market Cap.

Ex: “Asset X” has 1,000 shares with a Last Trade of $10 per share. This means the total value of “Asset X” (the market cap) = $10,000

• • •

For all additional questions, please contact our US based customer service team at hello@rallyrd.com.

Secondary market trading is offered through Dalmore Group, LLC, a member of the Financial Industry Regulatory Authority (FINRA) and the Securities Investor Protection Corporation (SIPC). All answers related to secondary trading functionality are being provided by Dalmore Group, LLC. Rally is not a licensed broker-dealer and neither Dalmore Group, LLC nor Rally make investment recommendations and no communication should be construed as a recommendation for any security offered on or off this investment platform. No answer provided by Rally should be construed as being related to any specific security or order. Only Dalmore Group, LLC may answer questions related to specific securities or orders on the secondary platform.