FAQ

Before investing in any offering on Rally please be sure to review important investment documents located in the legal section of each asset portal. It is VERY important to us that you completely understand all of the risk factors when investing in our securities. Visit Disclaimer and Terms of Service for additional information.

-

What is Rally?

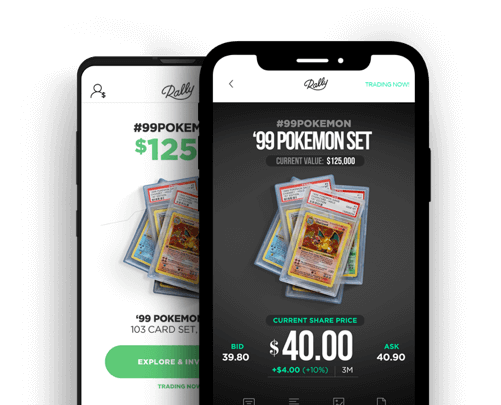

Rally is home to the most important collectibles in the world, and is the leading platform for owning and trading equity shares in those collectibles. Inside the Rally app, you’ll find everything from 65 million year old dinosaur fossils and a classic Ferrari, to the rarest sports cards ever printed, and even digital assets and .com domains – and you can add all of them to your investment portfolio, similar to a stock.

-

How does it work?

How does investing work on Rally?

The short answer: It feels a lot like buying shares in the stock market. Imagine Rally as a digital museum where you can pick any collectible that you want to own a piece of – maybe a dinosaur skull, or a vintage Ferrari. By buying a share, you’re actually becoming a co-owner of that item. If its value goes up, so does the value of your piece, and if it earns more money than its operating costs, it can produce dividends. Ready to sell your share? Place an order and you can be matched with an interested buyer.

Who owns the assets?

Assets on Rally are owned by investors on the platform. When you invest in an asset on Rally, you become a part-owner of the asset through the sub-company which holds the asset.

How are the assets selected?

When selecting assets for Rally, we consider a variety of important factors such as rarity, historical significance, uniqueness, value, and condition. Our team collaborates with industry experts to ensure we’re making informed decisions. Not only do we seek out assets that captivate with their rarity and relevance, but we also meticulously monitor the market to ensure each asset has the potential for outsized returns.

How are assets stored and maintained?

Our assets are fully insured and kept in world class, climate-controlled facilities, watched over by our expert team and under 24/7 video surveillance.

Can I see the assets in person?

Yes. Besides being showcased at the Rally Museum at 446 Broadway, New York, NY, our museum-quality assets are also featured in various locations through pop-ups, special activations, and exclusive events designed to promote and enhance their value.

When does an asset Exit and what happens when it does?

An asset can Exit the Rally platform via a qualified buyout offer. When we receive a qualified buyout offer, we survey shareholders to vote on whether or not to accept the offer. If the Exit is approved, the asset will leave the platform and proceeds will be distributed to shareholders.

How is an asset’s market value calculated?

On Rally, the value of each asset is determined by its most recent share price. An asset’s market value is calculated by multiplying the total number of shares issued by the price of the last trade.

-

Getting Started

How do I make an account?

Setting up your Rally account is simple: First, head over to the app (iOS/Android). There, you’ll see fields asking for your email and a password. Go ahead and enter your email and create a unique password for your account and press the ‘Join Now’ button. After that, we’ll ask you to verify your account through an email we send over. Once verified, you’re ready to dive into the exciting world of investing with Rally. You can navigate to your portfolio to add funds, explore investment opportunities in the trading section, or delve into detailed histories of the renowned assets available on the platform. We’re here to support your investment journey every step of the way.

Who can invest?

If you’re over 18, have a U.S. Social Security number, a bank account, ID, and an address in the contiguous U.S., you’re all set to invest with us, as long as you clear the usual checks for identity and anti-money laundering. While our app is open for everyone to explore, investing is reserved for those who meet these criteria. To invest internationally or through a business, contact us at support@rallyrd.com to get started.

-

Initial Offerings (IPOs)

How do I invest in an Initial Offering on Rally?

Investing in an Initial Offering on Rally is straightforward. Just find the asset you’re interested in and click the ‘Buy Shares’ button on that asset’s page. Choose the number of shares you’d like to buy, and then you’ll be asked to fill out a brief investor onboarding questionnaire and finalize your purchase.

How do I pay for my investments?

Funding your investments on Rally is straightforward—just link your bank account to your Rally investment account using Plaid. This secure connection facilitates your transactions, allowing you to pay for investments directly if your Rally balance doesn’t cover the purchase, through an automated-clearing-house (ACH) transfer.

-

Trading

How does live trading work?

Live Trading lets buyers and sellers interact directly by placing Bid and Ask orders for shares of specific assets. These orders go through a broker-dealer to be matched in real-time when the market is open.

Market Hours are Monday through Friday, from 10:30 AM ET to 4:30 PM ET, excluding national stock market holidays. When the market is closed, assets go into “Post-Only”. During Post-Only you can place and edit orders, however orders will not match again until the market is open.

Are there fees to Buy or Sell shares?

There are no fees for you when buying or selling shares with us.

Can I buy shares even if I missed an IPO?

Yes. Even if you didn’t catch an asset during the IPO, you can still place buy orders, or “Bids,” once the asset opens for trading (usually around 90 days after the IPO closes).

What does it mean when trading is halted?

On occasion, Rally may halt trading on the platform for certain assets. This halt means you temporarily won’t be able to place Bid or Ask orders for the affected asset in the Rally app. Reasons for a trading halt could include a pending buyout offer for the asset or necessary platform downtime for maintenance. This measure is taken to ensure trading integrity and fairness for all participants.

How does order matching work?

Buy (Bid) and sell (Ask) orders are matched when their prices align or cross. A price alignment occurs when a Bid equals an Ask, and crossing happens when a Bid is higher than existing Asks or an Ask is lower than existing Bids. Orders are prioritized by best price and time submitted.

For example, imagine two investors place a Bid for the asset, one for $10 and one for $5. If there’s an open Ask to sell at $5, the higher priced Bid has priority and will be matched first.

Similarly, if two investors place a Bid for an asset at the same share price of $10 and there’s a matching Ask, the Bid which was placed first has priority and will be matched first.

All open orders are visible 24/7 in the asset’s order book on the Rally app, and orders placed outside of Market Hours are queued and processed the next time the market is open.

What is a partial match?

A partial match happens when only part of your Bid or Ask order gets matched with another user’s order. This matched part goes through as a separate transaction, and whatever’s left of your order stays open until it is matched or canceled.

You can view, edit, or cancel partially-filled orders from your Portfolio.

How does the value of my investment increase or decrease in value?

The value of your investment fluctuates based on the share price of the last trade. We also monitor comparable sales of collectibles that are the same or similar to the asset. Sales of comparable assets may differ from in-app values due to differences in condition as well as outside market trends.

-

How do I place a Bid or Ask order? (How to Buy or Sell Shares)?

How do I create an order to buy or sell shares?

To buy shares in an asset, click on the asset in-app and select “BUY (Bid)”. You can click Instant Buy to buy 1 share instantly at the low ask price, or you can click Limit Order to specify the price and the quantity of shares you’d like to purchase. To place a Bid, you need enough cash in your Rally account to cover the order.

To sell shares you own in an asset, click on the asset in-app and select “SELL (Ask)” to create an Ask order. You can then select the price and the quantity of shares you want to sell.

How long does it take to get my shares after a Bid executes and when can I resell them?

Shares you purchase will show up immediately in the “Portfolio” section of the Rally app after your Bid has been matched and executed.

There is a 5 business day wait time before shares can be resold to accommodate the settlement period for custody transfer of the shares.

How do I know if my order was completed?

All transaction details, whether you’re buying or selling, will be immediately visible in your transaction history upon execution.

How long does it take me to get cash after I have my Ask executed?

Within 2 business days.

What happens if I place an order and it doesn’t get matched?

Your order will remain active as “Good-Till-Canceled” until it is either successfully matched and executed, or you choose to cancel it.

Are there specific rules on the types of orders I can place?

Asks can’t be set below 30% of the asset’s most recently executed trade price, and you can’t have both a Bid to buy and an Ask to sell on the same asset open at the same time.

Can I cancel my Bid or Ask?

Yes, you can cancel or edit your Bid or Ask anytime before it finds a match on the secondary market. You can make any changes to your pending orders directly from the Portfolio section of the Rally app.

-

Funding

What are the requirements for placing a Bid?

To place a Bid on the Rally app, you must have a cash balance in your Rally account that covers the total Bid amount. For instance, to bid on 10 shares at $5 each, your account needs a minimum balance of $50. If your balance falls short, you can utilize Instant Cash for an immediate boost. Adding funds is straightforward: select “Banking” in the app’s “Portfolio” section to get started. Note that bank transfers typically clear within one business day. As a note, having a cash balance applies when placing a Bid but is not necessary to invest in an IPO.

What is “Instant Buy”?

“Instant Buy” is a feature you can select during the order process which allows you to purchase a single share at the current lowest asking price.

What is Instant Cash?

Instant Cash is a feature that allows you to immediately use funds transferred to your Rally Cash Balance on the secondary market, instead of having to wait for them to clear.

Who is eligible for Instant Cash?

To use Instant Cash, you need a bank account linked to your Rally account.

How do I make a deposit on the Rally app using iOS or Web?

On iOS, begin by opening the Rally app and tapping the button in the top left corner to navigate to your Rally Portfolio. Then, choose “Add Funds.” Enter the amount you want to deposit and tap the add funds button to finalize your deposit.

To deposit funds through the web, log in at rallyrd.com/app. Once logged in, click in the top left corner to go to your Rally Portfolio. Select “Add Funds,” enter the desired deposit amount, and then click the add funds button to complete the process.

-

What are the risks?

What are the risks?

Investing always comes with its share of risks, and the opportunities on our platform are no exception. Your investment’s value can go up or down, and there’s never a guarantee you’ll find a buyer at your desired price when you’re ready to sell. Collectibles come with their own unique set of risks due to their tangible nature. For more comprehensive information, visit www.rallyrd.com/disclaimer.

-

How can I list my item on Rally?

I have an asset I think would be a great fit for Rally — can I list it on your site?

If you’ve got an asset you believe would shine on the Rally platform, we’d love to hear about it. Just head over to our asset submission site, click here, and share the details with us. Our asset acquisition team will take a look and get in touch within 24 hours if your asset catches their interest.

-

How can I buy an entire asset from Rally and take possession of it?

How can I submit an offer to buy one of the assets?

Want to buy an asset outright? Let’s talk. Click the button at the bottom of the asset’s page and submit your buyout offer, or email us directly here.

-

How do buyouts on Rally Work?

How do buyouts on Rally Work?

Buyouts on Rally are straightforward. Once an asset finishes its Initial Offering, it’s open to receiving offers. Here’s how buyouts are handled

- Offer is Made An investor has made an offer to purchase an asset outright.

- Offer Review Rally’s in-house team makes sure the offer is a qualified legitimate offer. Once an offer is qualified, Rally will secure an escrow deposit from the buyer.

- Shareholder Vote All trading on that asset is halted, and shareholders of the asset are given 48 hours to place their vote of “Yes”, “No”, or “let the Advisory Board decide”.

- Advisory Board Decision After the poll, the Advisory Board looks over the results, to ensure final call aligns with market conditions.

- Deal or No Deal If the Advisory Board approves the buyout, we let everyone know, and investors will see their share of the funds in 1-2 weeks. If the offer’s a no-go, the asset returns to live trading.

Offer Qualification

During review, a buyout offer is evaluated against the asset’s current price as listed in the Rally app after corporate taxes and entity fees. Rally also assesses the offer by analyzing direct sales, similar transactions, indices, and the latest market trends for the asset.

Competing Offers

After a poll has begun, if a competitive offer of at least 5% above the current offer or greater is submitted, the initial bidder is notified and given a first right of refusal to match the new offer within a given time window.

If the initial bidder matches the new offer, a competitive bidding process begins. Upon each new bid entered, the other bidder is notified of the current bid and given a window to raise their offer by a minimum of 5% or greater, or withdraw.

Before the conclusion of the investor poll, if no bidder has withdrawn, bidders will enter into a best-and-final bid process. The bidder with the highest final bid wins and is obligated to pay the amount of their final entered bid.

-

Account Management

Will I receive any monthly statements or end of year tax documents?

Yes, monthly statements will be generated if you have active investments in your portfolio. Statements become available by the first week of the following month.

You’ll receive a Form 1099 if you have a reportable event during the year such as selling shares or receiving dividends. If you don’t have a reportable event, you won’t receive a Form 1099. Tax documents will be available in your Portfolio by March of the following year.

How can I close my account?

Email us directly at support@rallyrd.com to close your account.

You can also submit a request to close your account by navigating to your Portfolio in the Rally app, clicking “My Profile & Settings”, “Profile and Account” , and then “Close Account”.

How can I view historical trading data?

For trading assets, you can view market cap and share price history by clicking on the asset, scrolling down to the graph, and selecting “Trading on Rally”. You can also click “View all Bids & Asks” to see the asset’s current order book.

From the Home screen in the Rally app, you can also see a feed of recent activity across trending assets. Navigate to your Portfolio to view data related to your own share purchases.

-

Business Accounts

Can I register for Rally as a business?

Yes, please reach out to hello@rallyrd.com if you are interested in opening a Rally business account for your business entity. Please note that there may be additional requirements and restrictions for international entities.

-

Security

How is my data protected with Rally?

At Rally, we keep your data safe and private with best-in-class encryption to protect your account and ensure your experience with us is secure. We keep your data safe and privately stored, and your information will never be sold.

Your account password is stored using the industry-standard BCrypt hashing algorithm and is never stored in plain text. BCrypt hashing is a scrambled format that makes password data difficult and time-intensive for attackers to crack.

We understand that you place a lot of trust in our services, and we’re constantly working to ensure Rally is a safe place for you to build your financial future.

How do I know it’s safe to invest on Rally?

All of our investments are audited annually, reviewed and vetted by a FINRA registered broker-dealer, and are subject to SEC regulations. We are committed to transparency in our investing process — all details we have on our assets are publicly viewable whether you have invested or not. If you have questions or need help, we are just an email away at support@rallyrd.com.

Cautionary Statement Regarding Forward-Looking Statements

This FAQ includes some statements that are not historical and that are considered “forward-looking statements” within the meaning of Section 27A of the Securities Act. Such forward-looking statements include, but are not limited to, statements regarding our development plans for our business, our strategies and business outlook, anticipated development of the platform and our product offering, and various other matters. These forward-looking statements express expectations, hopes, beliefs, and intentions regarding the future. The words “anticipates”, “believes”, “continue”, “could”, “estimates”, “expects”, “intends”, “may”, “might”, “plans”, “possible”, “potential”, “predicts”, “projects”, “seeks”, “should”, “will”, “would” and similar expressions may identify forward-looking statements, but the absence of these words does not mean that a statement is not forward-looking.

The forward-looking statements contained in this FAQ are based on current expectations and beliefs concerning future developments that are difficult to predict. We cannot guarantee future performance, or that future developments affecting us will be as currently anticipated. These forward-looking statements involve a number of risks, uncertainties (some of which are beyond our control) or other assumptions that may cause actual results or performance to be materially different from those expressed or implied by these forward-looking statements.

You should not place undue reliance on any forward-looking statements and should not make an investment decision based solely on these forward-looking statements. We undertake no obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as may be required under applicable securities laws.

For detailed information please visit www.rallyrd.com/disclaimer. Offering circulars related to our investment opportunities can be found in the app, on the SEC website, and at https://rallyrd.com/investors.