BATMAN #1 COMIC BOOK INVESTMENT MEMO

-

Asset:

1940 D.C. COMICS BATMAN #1 GRADED CGC 8.0 COMIC BOOK

-

Market Cap:

$1,800,000

-

Number of Shares:

180,000

-

Share Price:

$10.00

"*" indicates required fields

Executive Summary

-

GROWING MARKET

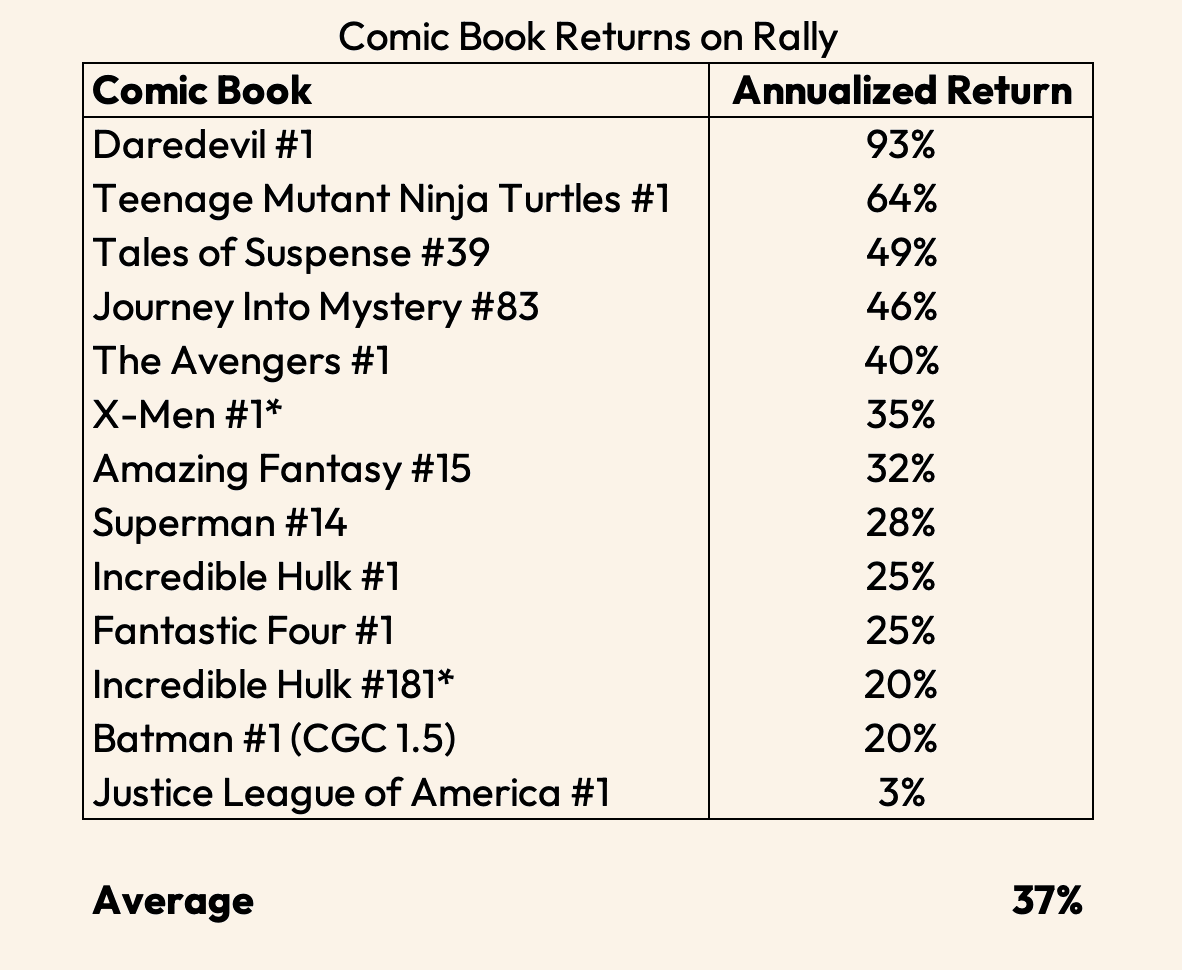

Comic books have had the most exits for any category on the Rally platform and an average annualized return of +37%. (1)

-

HISTORIC COMIC BOOK

Batman #1 is the first issue of the character’s self-titled series and one of the most significant comic books in history, featuring the first appearance of the Joker and Catwoman. (2)

-

VALUATION

Rally is offering this asset for $1.80M. The estimated current value for this comic book is $1.96M. (3),(4),(5)

-

ANNUALIZED RETURN

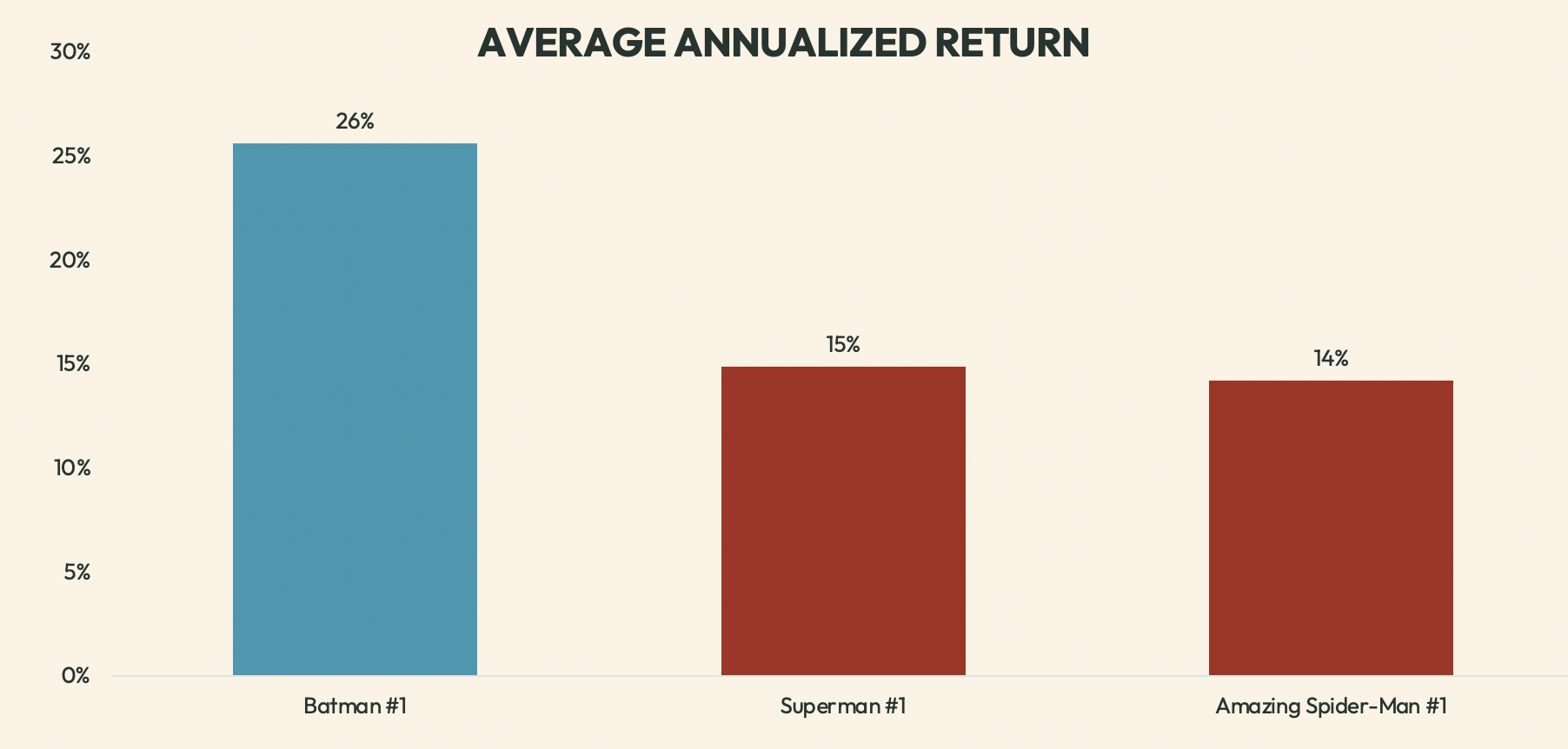

Batman #1 has historically demonstrated higher annualized returns than comparable books like Superman #1 and The Amazing Spider-Man #1. (6)

Growing Market

In 1973, the New York Times published an article entitled “Comic Books Can Prove Super Investment” in which the author discusses the emerging trend of treating comic books as an investable asset class. (7 ) The founding of Certified Guaranty Company (CGC) in 2000 catalyzed the growth of the market further with a standardized grading system and authentication process. (8) Twenty-two years later, comic books have become one of the largest and most mature collectibles markets with several grading services and numerous auction houses serving the industry. Heritage Auctions’ Comic Books & Comic Art Dept. sales grew from $44.3M in 2017 to $181.6M in 2021 (gain of +300%). (9),(10) Despite the onset of the COVID-19 pandemic, record sales remained strong with five comic books selling for over $3M since 2021. (11)

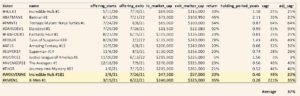

Rally began offering comic books in 2020 and since then thirteen comic books have been sold off the platform. The average annualized return for these comic books is +37%. In July 2022, a lower graded copy (CGC 1.5) of Batman #1 was sold on Rally for a 46% return, which represented an annualized return of 20% over two years. (12) As an asset class, comic books have had the most exits off the Rally platform.

Fig. 2: Annualized returns for exits in the Comic Book category on Rally. Comic books with an asterisk show gross return in place of annualized return because the holding period was less than six months.

“

For a long time, the big key issues…have been greatly outgaining everything else.

– Lon Allen from Heritage Auctions (23)

Historic Comic Book

Batman’s origin dates back to 1939 when National Comics Publications (later DC Comics) was working on concepts for their next superhero to follow up on the success of Superman. Artist Bob Kane and writer Bill Finger developed the idea of a masked anti-hero with a double identity, and Batman made his initial debut in Detective Comics #27. (13) The character was an overnight success and became so popular that he was given his own series less than a year later.

Rally is offering the first issue in that self-titled series: a 1940 DC Comics Batman #1 graded CGC 8.0. Within the world of collectible comics, the criteria that drive value are grade, rarity and cultural significance. Batman #1 is one of the most significant and valuable titles from the Golden Age of Comic Books (1938-1956).

The issue features the first appearance of the Joker and Catwoman, both of whom would go on to have their own series and feature films. (14) Additionally, Rally’s copy has several attributes that increase its value: it received the highest designation for page quality (WHITE) and was previously owned by famed collector Lamont Larson, who accumulated an extensive catalog of over one thousand Golden Age comic books. (15)

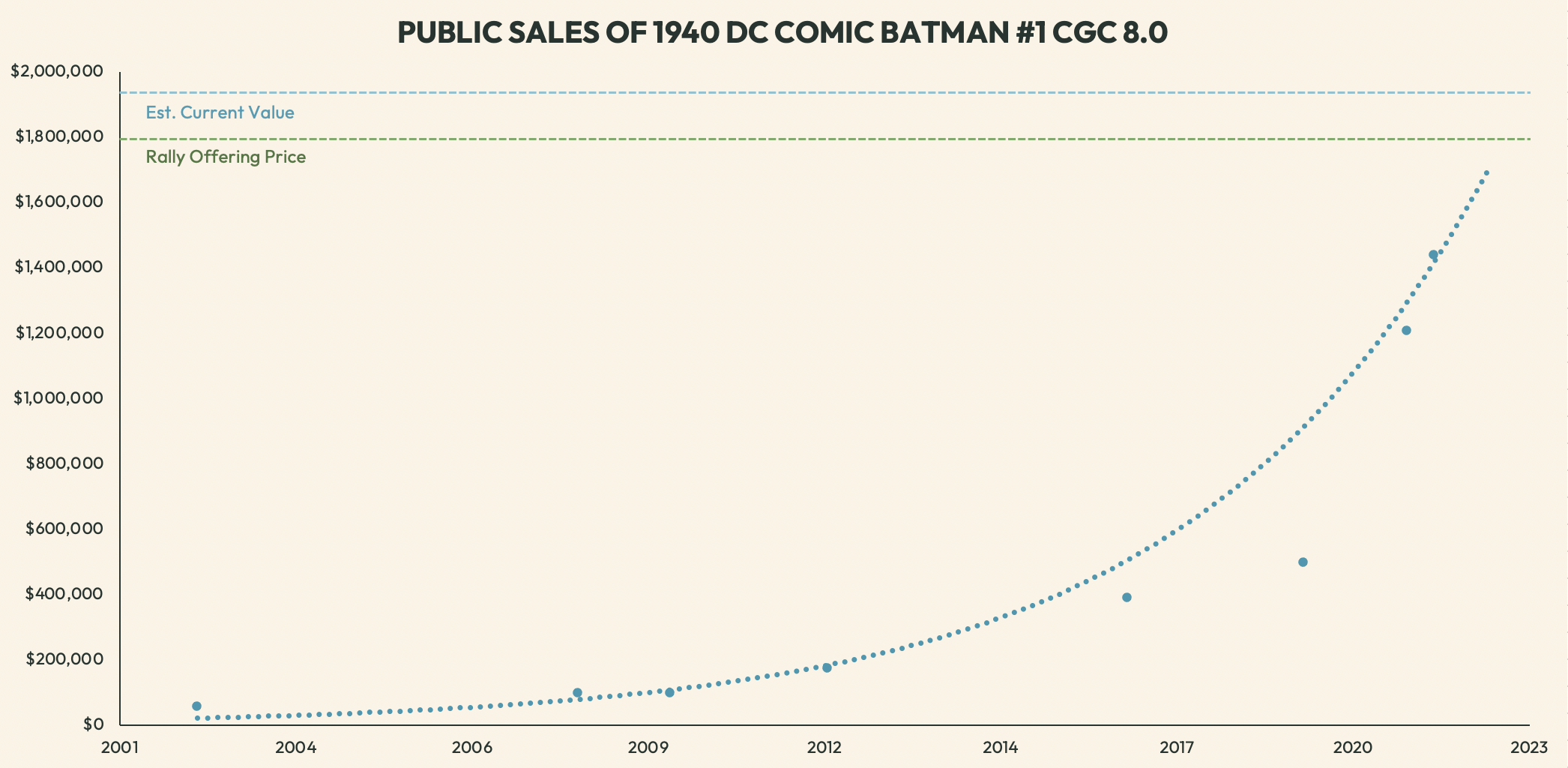

Valuation

When Batman #1 was originally published in 1940, it is estimated that hundreds of thousands of copies were printed for distribution. (16) Today, there are under 300 copies that have been graded by CGC and only 13 examples are graded CGC 8.0 or higher (“high grade” copies), including Rally’s offering. Over the past twenty years, there have been just 12 sales of these high grade examples. (17) Notably, there has never been a down sale within this population, i.e., no new sale in the same grade

has ever been less than the previous sale.

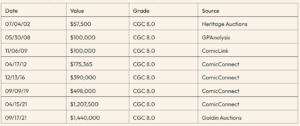

Since the early 2000’s, there have been eight publicly verifiable sales of Batman #1 in the same grade as Rally’s copy. (18) The most recent sale was for $1.44M in 2021. To calculate the compound annual growth rate (CAGR) and estimated current value for this offering, we looked at recent sales from the past ten years. Using the $390,000 sale from December 2016 and the $1.44M sale from September 2021, we calculated a CAGR of +31.54%. (19) By applying the growth rate to the most recent sale, we estimate the current value of this Batman #1 example to be $1,959,354 as of November 1, 2022. (20)

Fig 3: Historical public sales for examples of 1940 DC Comics Batman #1 graded CGC 8.0

Annualized Return

Fig. 4: Average annualized return for Batman #1, Superman #1, and The Amazing Spider-Man #1. The data includes all grades which had at least two sales in the last ten years.

-

$1,800,000

OFFERING

-

+31.54%

ANNUALIZED RETURN (21)

-

$1,959,354

ESTIMATED CURRENT VALUE (22)

The growth rate of Batman #1 compares favorably to other first issue comic books of the most popular superheroes: Superman and Spider-Man. In order to understand how this asset appreciates on a relative basis to other significant issues, we compared its growth rate to that of Superman #1 (first self-titled Superman issue) and The Amazing Spider-Man #1 (first self-titled Spider-Man issue).

First, we gathered all publicly verifiable sales of the three comic books across all grades from the past ten years. We calculated the CAGR for every grade with at least two sales in that time frame and averaged them together to determine an average annualized return for each book. Batman #1 demonstrated the highest average annualized return of 26% compared to 15% for Superman #1 and 14% for The Amazing Spider-Man #1. (24)

- 1 The “Comic Book” category has had a total of thirteen exits off the Rally platform since 2021, which is more than any other asset category. To calculate the holding period, we measured the difference in years between the offering start date and the offering exit date. To calculate annualized return, we used the following formula: CAGR = (( EV / BV ) ^ 1/n ) -1 ) X 100. The variables for each comic book used were as follows: EV = exit market cap; BV = io market cap; n = holding period (years). For any asset with a holding period of less than six months, we used the gross return instead of the compound annual growth rate to provide a more realistic estimate of appreciation. These assets are highlighted in yellow in the table below. Using the results, the average annualized return for exits in the Comic Books category was 37%. The following table includes the ticker, asset name, offering date, offering market cap, exit date, exit market cap, return, holding period, compound annual growth rate and adjusted compound annual growth rate for each asset:

- https://www.cbr.com/dc-batman-rarest-comics-worth/

- There have been eight publicly verifiable sales of Batman #1 graded CGC 8.0:

- Using the $390,000 sale on 12/13/2016 and the $1,440,000 sale on 09/17/2021, we calculated a compound annual growth rate (CAGR) using the following formula: CAGR = ((( EV/BV ) ^1/n ) – 1 ) X 100. The values for this formula are as follows: EV = $1,440,000; BV = $390,000; n = 4.76. The resulting CAGR is +31.54%. Both sales used for this calculation were identically graded examples of a 1940 DC Comics Batman #1 comic book. We cannot make any representation or prediction that this calculated compound annual growth rate is useful or accurate in determining the value of the Underlying Asset, and you are urged not to place undue reliance on this data or methodology. Additionally, past transaction data is not intended to indicate past or expected performance of any security. Third party transaction data, like shown above, is sourced from publicly available third-party websites, and there is no guarantee as to the veracity of the information, and we cannot confirm that the transaction occurred.

- To estimate the current value of the Underlying Asset, we used the following formula: FV = PV * (1+r)^t. t was the time difference in years between 09/17/2021 and 11/01/2022. The values for this formula are as follows: PV = $1,440,000; r = 31.5438576829995%; t = 1.12. The resulting estimated current value is $1,959,354.41. We cannot make any representation or prediction that this calculated current value is useful or accurate in determining the value of the Underlying Asset, and you are urged not to place undue reliance on this data or methodology. Additionally, past transaction data is not intended to indicate past or expected performance of any security. Third party transaction data, like shown above, is sourced from publicly available third-party websites, and there is no guarantee as to the veracity of the information, and we cannot confirm that the transaction occurred.

- To calculate the average annualized return across all grades for Batman #1, Superman #1 and The Amazing Spider-Man #1, we used the following procedure. All publicly verifiable sales available from GoCollect were collected for each of the comic books across each grade. We filtered out any sales that occurred more than ten years ago (11/01/2012) and subsequently removed any grades that did not have at least two sales within the past ten years. With the remaining grades for each comic book, a CAGR was calculated using the first and last sale from the time period according to the following formula: CAGR = ((( EV/BV ) ^ 1/n ) – 1 ) X 100. The average and standard deviation for each comic book’s annualized return was calculated and outliers were removed that were + 2.5 standard deviations. Batman #1 demonstrated the highest average annualized return of 26% compared to 15% for Superman #1 and 14% for The Amazing Spider-Man #1. We cannot make any representation or prediction that this calculated average compound annual growth rate is useful or accurate in determining the value of the Underlying Asset, and you are urged not to place undue reliance on this data or methodology. Additionally, past transaction data is not intended to indicate past or expected performance of any security. Third party transaction data, like shown above, is sourced from publicly available third-party websites, and there is no guarantee as to the veracity of the information, and we cannot confirm that the transaction occurred.

- https://www.nytimes.com/1973/01/01/archives/comic-books-can-prove-superinvestment-old-comic-books-are-proving-a.html

- https://www.cgccomics.com/grading/about-cgc/

- https://comics.ha.com/heritage-auctions-press-releases-and-news/heritage-auctions-sells-record-44.3-million-of-comics-and-comic-art-in-2017.s?releaseId=3355

- https://www.ha.com/heritage-auctions-press-releases-and-news/heritage-auctions-soars-past-1.4-billion-in-sales-in-2021-cementing-status-as-world-s-largest-collectibles-auctioneer-by-far.s?releaseId=4387

- https://www.cgccomics.com/news/article/10221/most-valuable-comics/#:~:text=For%20many%20years%2C%20Superman%20was,%2C%20it%20was%20Superman%20%231.

- See footnote 1.

- Daniels, Les (1999). Batman: The Complete History. Chronicle Books. ISBN 978-0-8118-2470-5.

- See footnote 2.

- https://www.cgccomics.com/resources/pedigree/larson/

- https://www.csmonitor.com/Books/chapter-and-verse/2010/0802/Batman-No.-1-a-rare-comic-book-goes-up-for-sale

- https://gocollect.com/app/comic/batman-1

- See footnote 3.

- See footnote 4.

- See footnote 5.

- See footnote 4.

- See footnote 5.

- https://www.forbes.com/sites/robsalkowitz/2021/06/23/what-the-hell-is-going-on-in-the-collectible-comics-market/?sh=706d54ca307c

- See footnote 6.