Blog > Research

Video Games Market Report | Q2 2023

Blog > Research

Video Games Market Report | Q2 2023

Key Takeaways

- 2022 Market Downturn – Total auction sales and average sale price declined significantly in 2022 from prior year highs. [1]

- Recent Stability – Heritage’s April Video Game Signature Auction had a 21% increase in total sales. [2]

- No Grails For Sale – There have been no public video game sales above $120,000 in 2023. [3]

Graded video games, a relative newcomer to the collectible ecosystem, experienced a rapid boom in demand during the pandemic alongside other alternative investments. The growth of the sealed vintage game market in 2021 coincided with the introduction of marquee video game auctions at Heritage (July 2021) and Goldin (September 2021), as well as the Collector’s Universe’s acquisition of video game grader WATA. [4] In the summer of 2021, record-breaking sales captured the public’s attention: a copy of Super Mario 64 sold for $1.56M in July [5], which was quickly followed by Rally’s own example of Super Mario Bros. selling for $2M just a month later. [6]

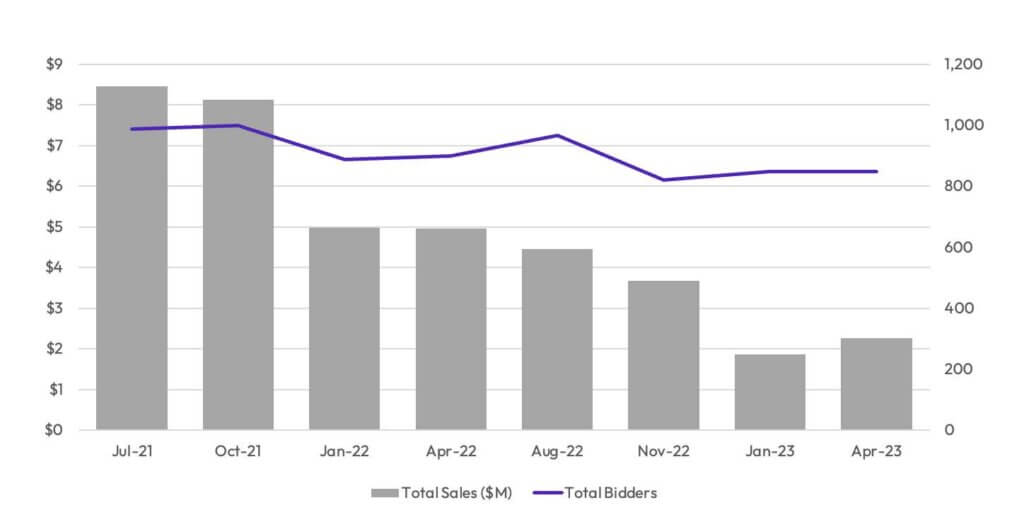

Beginning in 2022, there was a significant correction in the video game market in both total dollar volume sold at auction and the average price per game sold. At the height of the market in Q3 2021, Heritage Video Games Signature Auction achieved $8.4M in total sales with an average sale price of $17k. It is important to note, however, that two games accounted for $2.4M in sales (nearly 25% of the total volume). In the most recent Video Games Signature Auction (April 2023), Heritage had just $2.2M in total sales with an average sale price of $6k, representing a decline of 73% and 66%, respectively. [7]

While it has not returned to the highs of 2021, the video game market is exhibiting some bright spots in the first half of 2023. Firstly, more grading companies are moving into the video game space. In May of last year, CGC announced that they would begin grading video games [8] and those examples are beginning to appear alongside WATA-graded games at major auctions. Secondly, buyers and median sale price have remained relatively steady compared to other market metrics. From July 2021 to April 2023, unique bidders per auction only decreased by 14% as compared to a 73% decline in total auction sales, which suggests resilient demand among buyers. [9] During that same time period, median sale price decreased by 13% while, average sale price dropped 66%. [10] To understand this difference, it is useful to examine historical sales at the high end of the market.

In 2021, there were six games that each sold for over $500,000 at public auction. [11] In 2022, only one game sold for $500,000 and in 2023, no game has sold for more than $120,000. [12] The video game market certainly experienced a contraction in 2022, but the decline in average sale price can be explained in part by the absence of the most valuable games at auction.

Owners of rare examples seem to be hesitant to sell in adverse market conditions. Of the six games that sold for over half a million dollars in 2021, only one title had a comparable sale in 2022. A Hangtab example of Super Mario Bros. graded WATA 9.6 A+ sold for $660,000 in April 2021 [13] and a comparable copy graded 9.6 A sold for $720,000 in November 2022 [14], representing an appreciation of 9.1%. Therefore, it appears that the top of the market may be somewhat insulated from the downturn with select copies exhibiting slight appreciation and many collectors holding on to the most valuable pieces.

The results from Heritage’s most recent Video Games Signature Auction in April suggest that the market has achieved some degree of stability following the 2022 decline. Total sales volume, unique bidders, total lots, and median sale price are all up from January’s results. [15] In addition, the April auction featured a Matte Sticker-sealed copy of Duck Hunt graded WATA 9.6 A++ that tied the record for the most expensive game of 2023 at $120,000. [16] The upcoming auctions in Q3 will reveal whether vintage video games have corrected to a new normal following a bull run or whether a headline sale of a major copy can drive up prices across the market.

Figures

| Figure 2: Top 10 Video Game Auction Sales of 2023 [18] Game | Grade | Date | Price | Source |

| Legend of Zelda | CGC 9.4 A+ | January 2023 | $120,000 | Heritage Auctions |

| Duck Hunt | WATA 9.6 A++ | April 2023 | $120,000 | Heritage Auctions |

| Super Mario Bros. | WATA 8.0 A | April 2023 | $96,000 | Heritage Auctions |

| Mario Kart 64 | CGC 9.8 A++ | January 2023 | $81,000 | Heritage Auctions |

| Soccer | WATA 8.5 B+ | April 2023 | $66,000 | Heritage Auctions |

| Super Mario Bros. 3 | CGC 9.8 A++ | January 2023 | $60,000 | Heritage Auctions |

| Nintendo World Championships | CGC FN+ 6.5 | March 2023 | $57,500 | Metropolis Comics |

| Sonic the Hedgehog | CGC 9.6 A | January 2023 | $50,400 | Heritage Auctions |

| Donkey Kong | VGA 80 | April 2023 | $50,400 | Heritage Auctions |

| Legend of Zelda | WATA 9.2 A | January 2023 | $48,000 | Heritage Auctions |

| Super Mario World | CGC 9.4 A | April 2023 | $43,200 | Heritage Auctions |

Footnotes

- All calculations for total dollar volume of video games sold at auction, the average price per game sold at auction, the median price per game sold at auction, and unique bidders per auction are based on Heritage Auctions’ results for its “Video Games Signature Auctions” from July 2021 to April 2023.

- As compared to the Heritage Auctions January Video Games Signature Auction.

- Public auction data was collected from Heritage Auctions, Goldin Auctions and Metropolis Comics.

- https://hypebeast.com/2021/7/collectors-universe-wata-games-acquisition-news

- https://comics.ha.com/itm/video-games/nintendo/super-mario-64-wata-98-a-sealed-n64-nintendo-1996-usa/a/7261-28137.s

- https://www.nytimes.com/2021/08/06/business/super-mario-bros-sale-record.html

- See footnote 1

- https://www.cgccomics.com/news/article/10201/

- See footnote 1

- See footnote 1

- Based on historical public auction sales from Heritage Auctions, Goldin Auctions and Metropolis Collectibles.

- See footnote 11

- https://comics.ha.com/itm/video-games/nintendo/super-mario-bros-wata-96-a-sealed-hangtab-1-code-mid-production-nes-nintendo-1985-usa/a/7242-93028.s

- https://comics.ha.com/itm/video-games/nintendo/super-mario-bros-wata-96-a-sealed-hangtab-3-code-mid-production-nes-nintendo-1985-usa/a/7290-28064.s

- See footnote 2

- https://comics.ha.com/itm/video-games/nintendo/duck-hunt-wata-96-a-sealed-matte-sticker-first-production-nes-nintendo-1985-usa/a/7307-28027.s

Disclaimers

Secondary market trading is offered through Dalmore Group, LLC, Member FINRA/SIPC. Neither Dalmore Group, LLC nor Rally make investment recommendations and no communication, through this app or in any other medium, should be construed as a recommendation for any security offered on or off this investment platform. Rally is not a licensed broker dealer. Brokerage accounts and services related to trading of securities are provided by DriveWealth, LLC, a SEC registered broker-dealer and member FINRA/SIPC. DriveWealth, LLC serves as the exclusive custodian for all securities issued by RSE Collection, LLC. You do have the right to opt out of the transfer of shares into a DriveWealth, LLC brokerage account by providing written notification to Rally at hello@rallyrd.com, with instructions as to where you would like your securities to be transferred. Please note that most brokers do not accept alternative assets, and that you will not be able to participate in Trading Windows in the Rally app, if you elect to opt out.

RSE Collection, LLC (“RSE Collection”), RSE Archive, LLC (“RSE Archive”) and RSE Innovation, LLC (“RSE Innovation”) are offering securities only through the use of Offering Circulars that are part of Offering Statements qualified by the Securities and Exchange Commission under Tier II of Regulation A. A copy of the RSE Collection, LLC Offering Circular may be obtained HERE, a copy of the RSE Archive, LLC Offering Circular may be obtained HERE, a copy of the RSE Innovation, LLC Offering Circular may be obtained HERE, in the “Legal” section of the Rally App, or by requesting a copy by e-mailing hello@rallyrd.com. This communication and the Offering Circulars may contain forward-looking statements and information relating to, among other things, RSE Collection, RSE Archive, and RSE Innovation respectively, their business plans and strategies, and their respective market sectors. RSE Collection’s, RSE Archive’s, and RSE Innovation’s actual results may differ materially from management’s current view of future events. Neither RSE Collection, RSE Archive, RSE Innovation nor any other person or entity assumes responsibility for the accuracy and completeness of forward-looking statements, and is under no duty to update any such statements to conform them to actual results.

“Share” or “Stock” refers to interests in a series of RSE Collection, LLC, a series of RSE Archive, LLC, or a series of RSE Innovation, LLC. Any investment in securities contains a high degree of risk. The offer and sale of securities is being facilitated by an unaffiliated third-party registered broker-dealer (member FINRA/SIPC) only in U.S. states where such broker-dealer is registered. This communication does not represent an offer to sell or buy securities. Neither RSE Markets, RSE Collection, RSE Archive, RSE Innovation, nor any third-party broker-dealer provides any investment advice or make any investment recommendations to any persons, ever, and no communication through the rallyrd.com website or in any other medium should be construed as such. These investments are not bank deposits (and thus not insured by the FDIC or by any other federal governmental agency), are not guaranteed by RSE Markets, RSE Collection, RSE Archive, RSE Innovation or any third-party broker-dealer and may lose value. Investors must be able to afford the loss of their entire investment. Comparable asset may be materially different from, or may not be of the same value or quality as, the assets acquired by any series of RSE Collection, any series of RSE Archive, or any series of RSE Innovation depending on a number of factors, including market conditions, location of sale, associated taxes, paint quality, originality of parts, condition of the asset, operating quality, ownership history and provenance, level of wear and other factors. Further, an investment in a series of RSE Collection, a series of RSE Archive, or a series of RSE Innovation is not an investment in the underlying asset. It is an investment in the series of RSE Collection, a series of RSE Archive, or a series of RSE Innovation that owns the asset. The value of interests in a series of RSE Collection, a series of RSE Archive, or a series of RSE Innovation may materially differ from the value of the underlying vehicle for many reasons, including market factors, fees charged by the asset manager, and restrictions on liquidity. Investors should conduct their own due diligence, and are encouraged to consult with a financial advisor, attorney, accountant, and any other professional that can help you to understand and assess the risks associated with any investment opportunity. Please refer to the offering circular for full details and disclosures, including a subscription agreement should you choose to invest. Full details and disclaimers on http://rallyrd.com/disclaimer.